Lithium could be the new gasoline as Tesla stokes demand

Struggling with toxic air pollution levels, China is looking to alternative fuels with renewed urgency. Battery grade lithium prices have spiked in the country since 2015, with the domestic rate of electric vehicle production reaching 37,000 units through May; its highest point in the year so far according to the latest reports. The appetite for electric vehicles is one that is being increasingly endorsed by government authorities as subsidies and tax breaks are hastily introduced to offset the more expensive retail prices. Bloomberg estimates that 35% of light vehicles sold will be electric by 2040, generating a battery market worth a projected US$250 billion.

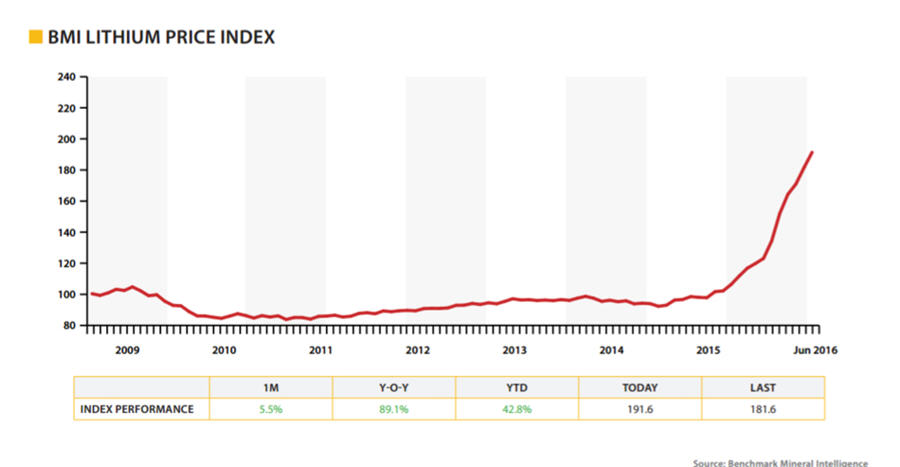

With the swell of recent battery orders, lithium prices climbed another 5.5% through June 2016. Panasonic, a leading provider in the industry, predicts that it will double battery sales by 2020. Data from Benchmark Mineral Intelligence showed a concurrent demand story: Lithium prices are up 43% so far this year, while the cost of intermediate refining product, lithium carbonate, jumped 4.3% through June 2016. Analyst expect prices to continue inflating throughout the rest of the year as industry majors struggle to expand their lithium output and gain access to raw materials.

Tesla has invested heavily in the renewable energy source. Elon Musk’s $5 billion Gigafactory development in Nevada is only 15% completed, but the company estimates it will be able to churn out half a million electric vehicles annually by 2018.

Musk has recently voiced aspirations to expand his lithium battery production globally, sighting Europe, India and China as potential factory locations. Other major car manufacturers are quickly joining the electric vehicle rush, scrambling to incorporate the electric batteries into their production line. In Germany, Daimler has committed US$550 million to creating a second lithium-ion battery plant, while GM and Nissan are also eyeing expansion deals.

Read MoreNemaska Lithium Preps Whabouchi Mine Site for 60,000 t Bulk Sample and Modular Mill Installation

QUEBEC CITY, QUEBEC–(Marketwired – Aug. 16, 2016) – Nemaska Lithium Inc. (“Nemaska Lithium” or the “Corporation”) (TSX:NMX)(OTCQX:NMKEF) is pleased to provide an update on the bulk sample and modular mill installation at the Whabouchi mine located in the Eeyou Istchee James Bay region, Quebec, Canada. Nemaska Lithium has applied for a Certificate of Authorization to install and operate a new self-contained dense media separation (DMS) modular mill. The modular mill has a processing capacity of 10 t/hour. The Corporation has also decided to increase the mine representative bulk sample from 29,000 t to 60,000 t. This bulk sample will be milled to obtain a 6% Li2O concentrate that will be further processed into lithium hydroxide at Nemaska Lithium’s Phase 1 Plant which is under construction in Shawinigan, Quebec. With the General Certificate of Authorization for the Whabouchi Mine site already in hand, Nemaska Lithium is not anticipating any issues with the ongoing further permitting and has given a mandate for site preparation and installation of the modular mill to Met-Chem Canada, member of the DRA Group. The Corporation is anticipating installation and commissioning of the DMS modular mill to be completed by the end of October 2016 with the mill producing a DMS concentrate over the next 12 to 18 months following the commissioning phase. Part of the DMS material will be further processed through flotation before being shipped to the Phase 1 plant in Shawinigan, Quebec.

“The modular mill is a critical component of our Phase 1 Plant project as it will produce the necessary concentrate that will be further processed into lithium hydroxide samples for customers that are seeking to qualify our products,” said Guy Bourassa, President and CEO of Nemaska Lithium. “With the recent addition of Mr. François Godin as VP Operations, I am very confident that this project is in good hands and we will be on track to start shipping mine representative commercial samples of lithium hydroxide to customers including Johnson Matthey Battery Materials by Q1 and Q2 2017.” Bourassa continued, “Qualifying ourselves with customers as a new lithium hydroxide supplier is normal course of business in this industry and is the rationale behind building the Phase 1 Plant and operating the DMS modular mill. This strategy will enable us to more rapidly start realizing revenue from the commercial Hydromet plant which is still on target for commissioning in Q2 2018.”

Read MoreDurango Phase One Exploration Completed at Nemaska Properties

Vancouver, BC / August 15, 2016 – Durango Resources Inc. (TSX.V-DGO), (the “Company” or “Durango“) announces that further to the news release of August 3, 2016, Durango’s exploration team has completed its inaugural field exploration program on its group of properties near Nemaska, Quebec.

Mr. Donald Theberge, P.Eng., M.B.A led the exploration program which included detailed mapping and sampling of the newly identified pegmatite outcrops and outcropping ridges on Durango’s Nemaska Whabouchi area properties. The helicopter assisted work program focused on reaching inaccessible areas to prioritize drill targets and was completed ahead of schedule thanks to the hard working exploration crew.

Previous work in 2011 outlined multiple pegmatite occurrences on Durango’s NMX East claims adjacent to Nemaska Lithium Inc. (TSX-NMX), and were evaluated for targets to be added to a drilling schedule. The program was successful in sampling the identified pegmatites and outcropping ridges which were not previously evaluated by any companies. A total of 87 grab samples were taken during the survey of the properties and the samples have been sent to ALS Minerals Laboratories in Val D’Or, Quebec. The geologists will supply information on the sampling program and issue a report on the work completed with correlating results as soon as they become available.

Read More