Why Lithium Is Set to Take Off Before Christmas $BFF.ca $DGO.ca $FMR.ca

From the age of gold to the age of coal, and then oil, we are now entering the age of lithium–and, more importantly, we’re at the crucial junction where this increasingly precious metal lives up to its newest moniker of “the white gasoline”. Prices have tripled, supply is already tight, and demand is poised to make new barons out of today’s lithium explorers.

More to the point, this is the moment when investment turns into profit; the moment when everyone stops hedging solid bets on lithium, and it all becomes a very profitable reality.

The supercharged electric vehicle industry may be in a bit of a panic over readily available lithium supply, but the problem isn’t supply itself–lithium is quite abundant. The problem is finding and developing new supply to keep pace with voracious new demand.

It’s also about looking beyond the obvious and casting a wider exploration net. The land rush is already on in full force in the Clayton Valley in Nevada—ground zero for the American lithium boom. Nevada’s geology tells a much more lucrative story, and so far we’ve only got the introduction.

Junior pure-play miners like Nevada Energy Metals (OTCQB:SSMLF) are starting to look beyond the obvious in Nevada–casting the exploration net much wider while at the same time securing production in Clayton Valley, the heart of the lithium land rush. The new game-changing strategy is to focus on diverse acquisitions of high-quality lithium acreage, turning this pure-play miner into a major project generator.

Cornering first new production and simultaneously capturing second phase new production from completely unexplored and untapped Nevada terrain is the key to cashing in on the lithium boom in both the near-term and long-term.

And if you don’t see how this is playing out, just look at the EV segment. It’s already going mainstream, even UBER has jumped on board. There is no turning back.

Tesla has stormed the mainstream U.S. market with its newest model; EVs have already entered the profit stage in Norway, and will soon be followed by the Netherlands, helped out by some EV-market-loving laws that demand that every single car in the country be electric by 2025. In Asia, too, EVs are bursting the traditional car bubble.

And with a mind-boggling 12 battery gigafactories on the books globally, we’re looking at a supply and demand equation that is overwhelming in favor of the new lithium miner.

This market will wait for no one, and that’s why we like Nevada Energy Metals’ exploration and production strategy and ambition.

Here are 10 reasons to keep a close eye on Nevada Energy Metals (OTCQB:SSMLF):

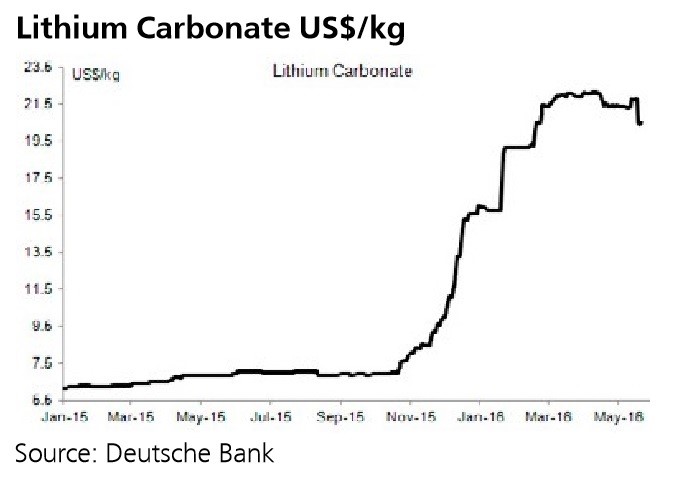

1. The Floodgates Have Opened, Prices Have Tripled.

Spiking from $7,000 per ton to over $20,000 per ton, the floodgates were suddenly opened for a new game on a new playing field, with a commodity that isn’t even traded like a commodity—yet. This revolution knows no bounds, and the next thing that will happen will be the end of the lithium oligopoly and the dawn of the new entrant. New lithium projects on highly prospetive land are the new rage. What investors are craving at the tipping point in this lithium boom is a lower market cap combined with strong management and solid near-term and long-term strategy.

2. Supply Tighter than Anything We’ve Ever Seen.

The surge this year in spot prices in China, the ravaging hunger for lithium batteries and power storage solutions has triggered fears that we are on the edge of a major supply problem—but it’s a euphoric problem for lithium exploration companies and it has opened up the playing field to new entrants.

3. Not just Acquisitions. This is a project generator

At prime time in a land rush, there’s nothing we like to see more than a company that is ambitiously scooping up the most diverse portfolio of lithium exploration land in the heart of the American lithium boom. Nevada Energy Metals is focused on the acquisition of high-quality acreage. The company is positioning itself as a project generator, strategically staking high potential land while negotiating joint-ventures to cover exploration costs while still maintaining the ability to cherry pick the project they want to develop 100% in-house. This model has earned the company US$ 400,000 in cash (the number reflects payments that have been received as well as future payments that are part of the current agreements), plus cash equivalents with unlimited growth potential.

4. Diversified Portfolio of Well Located Nevada Lithium Projects.

This Canada-based company differs significantly from other pure-play lithium explorers in that it is not stubbornly focused on just a couple of deposits where everyone else is flocking, such as Clayton Valley. Nevada Energy Metals is changing the way this game is played by making the lithium playing field in Nevada more attractive to potential investors. It’s casting a much wider exploration net around this area, based on geology that mirrors the lithium-producing Clayton Valley, because in all likelihood, given the geothermal footprints at play here, Nevada has a lot more lithium than anyone ever imagined. When it comes to de-risking, this company has figured out what investors want: They want a foothold in lithium where risk is lessened by diversification.

5. Early Exploration Moving Fast.

Nevada Energy Metals already has seven projects in Nevada, and exploration is moving at breakneck speed. Already on 1 September, the company announced that samplings from its Big Smokey Valley project (100% owned) returned high-level Lithium values in 150 out of 170 samples. And this project covers an impressive 3,200 acres. The results are more than encouraging. In Big Smokey Valley, Nevada Energy Metals has 160 placer claims in an area with three geothermal resources, which means a high potential for commercial quantities of Lithium. Sampling also began in another 100% owned Nevada project in Black Rock Desert in late August.

6. Sweet Spot: Two Highly Prospective Properties.

Nevada Energy Metals’ Clayton Valley BFF-1 Lithium Project abuts the only producing lithium mine in the US—Albermarle’s (NYSE:ALB) Silver Peak Mine. This is where a lot of new entrants to the lithium game are clustering, and it’s ground zero in the land rush. It’s also in Tesla’s gigafactory backyard.

Then we’ve got Alkali Lake, which is a 60-40 earn-in agreement. This prime acreage is only about 12 kilometers from Albermarle’s solar evaporation ponds and 20 kilometers from another highly prospective lithium project owned by Pure Energy (TSX-V:PE). Geological findings in Alkali Lake show two deep-seated basins of prime lithium hunting grounds. Surface sampling results at Alkali Lake confirm the presence of near-surface lithium.

7. Banking on Nevada’s Geology: Two Forward-Looking Plays.

Nevada Energy Metals’ Teels Marsh West project is about 48 miles outside of the Clayton Valley area. Here the company has staked 100 placer claims covering an impressive 2,000 acres—all of which is highly prospective lithium grounds in tectonically active territory bounded by faults. And for investors who are all about de-risking, this is 100% wholly owned, with no royalties.

Further diversifying this portfolio, the company has the Sam Emidio property, in the desert by the same name. Until recently they had 69 claims here, but as of 26 April, Nevada Energy Metals has expanded to this 155 claims. It’s another very promising lithium hunting ground, with historical data showing lithium value in brine from a depth of 1.5 meters.

8. The Best Yet—Fully Funded.

Early this year, the company raised over $1 million through refinancing and several private placements. In May, it announced the upgrade of its shares’ listing from the Pink Open Market to the OTCQB Venture Market. Nevada Energy Metals also has a listing in Frankfurt, Germany. The company’s operations are fully funded and has paid in full all annual Bureau of Land Management (BLM) maintenance fees for the Company’s seven Lithium projects for the Sept. 2016- Sept. 2017 period.

9. A Boom-Time Dream Team.

Nevada Energy Metals has earned a reputation as a brilliant project generator, a smart company with clear priorities that knows which projects are best developed in partnerships and which ones are best left in-house and then sold. This would not be possible without an experienced team of experts with decades of experience in the natural resources industry and, importantly, fundraising. Malcolm Bell, lead consultant for project acquisitions and Advisory Board member, has a stellar 45-year track record with both public and private companies. The latest addition to the star team is Chief Operating Officer Tim Fernback, who brings 20 years of experience in investment banking and corporate finance. Fernback has been responsible for fundraising operations worth a total $750 million, including 50 IPOs. And more recently, they have added Randy Avon to the advisory board. His proven track record of locating rare business opportunities, negotiating projects, as well as negotiating joint ventures/option agreements is a perfect fit to the project generator model. This former member of the Florida Legislature, former President and CEO of four World Trade Centers has completed over $8 Billion in infrastructure projects with E.F.Hutton and Prudential Bache and formed Asian Pacific Development Corp, which has completed over $18 billion dollars in global infrastructure projects.

10. A Very Smart, Very Strategic Future.

Nevada Energy Metals is actively working to establish key strategic partnerships with other lithium explorers and producers. The latest among these was the joint venture closed with American Lithium Corp. for the development of Nevada’s BFF-1 project. It also has a network of dedicated investors, which helps ensure the success of fundraising.

If you have any doubts about how to play the lithium boom—think junior, and think diverse lithium plays. This is the best way to gain exposure to this precious metal that is already seeing demand overtake supply. By the fourth quarter of this year, you may already have missed the critical moment because China’s EV demand in particular is poised to push prices up in this period.

Again, it’s a market that simply won’t wait for you. Lithium trading at over $20,000 per metric ton is just the very beginning. We haven’t seen anything yet.